Definition

Porter’s five forces model is an analysis tool that uses five industry forces to determine the intensity of competition in an industry and its profitability level.[1]

What is Porter’s Five Forces

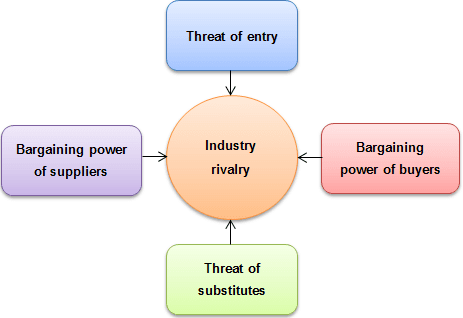

The Five forces model was created by M. Porter in 1979 to understand how five key competitive forces are affecting an industry. The five forces identified are:

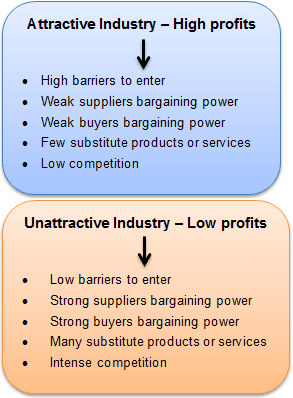

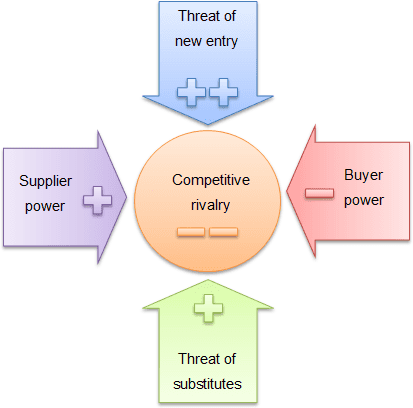

These forces determine an industry structure and the level of competition in that industry. The stronger the competitive forces in the industry are, the less profitable it is. An industry with low barriers to enter, having few buyers and suppliers but many substitute products and competitors will be seen as very competitive and, thus, not so attractive due to its low profitability.

It is every strategist’s job to evaluate the company’s competitive position in the industry and to identify what strengths or weaknesses can be exploited to strengthen that position. The tool is very useful in formulating a firm’s strategy as it reveals how powerful each of the five key forces is in a particular industry.

Threat of new entrants. This force determines how easy (or not) it is to enter a particular industry. If an industry is profitable and there are few barriers to enter, rivalry soon intensifies. When more organizations compete for the same market share, profits start to fall. It is essential for existing organizations to create high barriers to entry to deter new entrants. Threat of new entrants is high when:

- Low amount of capital is required to enter a market.

- Existing companies can do little to retaliate.

- Existing firms do not possess patents, trademarks or do not have established brand reputation.

- There is no government regulation.

- Customer switching costs are low (it doesn’t cost a lot of money for a firm to switch to other industries).

- There is low customer loyalty.

- Products are nearly identical.

- Economies of scale can be easily achieved.

Bargaining power of suppliers. Strong bargaining power allows suppliers to sell higher-priced or low-quality raw materials to their buyers. This directly affects the buying firms’ profits because they have to pay more for materials. Suppliers have strong bargaining power when:

- There are few suppliers but many buyers.

- Suppliers are large and threaten to forward integrate.

- Few substitute raw materials exist.

- Suppliers hold scarce resources.

- Cost of switching raw materials is especially high.

Bargaining power of buyers. Buyers have the power to demand lower prices or higher product quality from industry producers when their bargaining power is strong. Lower price means lower revenues for the producer, while higher quality products usually raise production costs. Both scenarios result in lower profits for producers. Buyers exert strong bargaining power when:

- Buying in large quantities or control many access points to the final customer.

- Only a few buyers exist.

- Switching costs to other suppliers are low.

- They threaten to backward integrate.

- There are many substitutes.

- Buyers are price sensitive.

Threat of substitutes. This force is especially threatening when buyers can easily find substitute products with attractive prices or better quality and when buyers can switch from one product or service to another with little cost. For example, switching from coffee to tea doesn’t cost anything, unlike switching from car to bicycle.

Rivalry among existing competitors. This force is the major determinant on how competitive and profitable an industry is. In a competitive industry, firms have to compete aggressively for market share, which results in low profits. Rivalry among competitors is intense when:

- There are many competitors.

- Exit barriers are high.

- Industry growth is slow or negative.

- Products are not differentiated and can be easily substituted.

- Competitors are of equal size.

- Low customer loyalty.

Although Porter originally introduced five forces affecting an industry, scholars have suggested including the sixth force: complements. Complements increase the demand of the primary product with which they are used, thus, increasing the firm’s and industry’s profit potential. For example, iTunes was created to complement the iPod and added value for both products. As a result, both iTunes and iPod sales increased, increasing Apple’s profits.

Using the tool

We now understand that Porter’s five forces framework is used to analyze industry’s competitive forces and to shape organization’s strategy according to the results of the analysis. But how to use this tool? We have identified the following steps:

- Step 1. Gather the information on each of the five forces.

- Step 2. Analyze the results and display them on a diagram.

- Step 3. Formulate strategies based on the conclusions.

Step 1. Gather the information on each of the five forces. What managers should do during this step is to gather information about their industry and to check it against each of the factors (such as “number of competitors in the industry”) influencing the force. We have already identified the most important factors in the table below.

| Porter’s Five Forces Factors |

| Threat of new entry |

|---|

|

| Supplier power |

|

| Buyer power |

|

| Threat of substitutes |

|

| Rivalry among existing competitors |

|

Step 2. Analyze the results and display them on a diagram. After gathering all the information, you should analyze it and determine how each force is affecting an industry. For example, if there are many companies of equal size operating in a slow-growing industry, it means that rivalry between existing companies is strong. Remember that five forces affect different industries differently, so don’t use the same analysis results for even similar industries!

Step 3. Formulate strategies based on the conclusions. At this stage, managers should formulate a firm’s strategies using the results of the analysis. For example, if it is hard to achieve economies of scale in the market, the company should pursue a cost leadership strategy. A product development strategy should be used if the current market growth is slow and the market is saturated.

Although, Porter’s five forces is a great tool to analyze industry’s structure and use the results to formulate firm’s strategy, it has its limitations and requires further analysis to be done, such as SWOT, PEST or Value Chain analysis.

Example of Porter’s Five Forces

This is Porter’s five forces analysis example for the automotive industry.

| Porter’s Five Forces Evaluation |

| Threat of new entry (very weak) |

|---|

|

| Supplier power (weak) |

|

| Buyer power (strong) |

|

| Threat of substitutes (weak) |

|

| Competitive rivalry (very strong) |

|

Sources

- Porter, M.E. (2008). The Five Competitive Forces That Shape Strategy. Harvard Business Review. Available at: https://hbr.org/2008/01/the-five-competitive-forces-that-shape-strategy

- Wikipedia (2013). Porter’s Five Forces. Available at: https://en.wikipedia.org/wiki/Porter%27s_five_forces_analysis